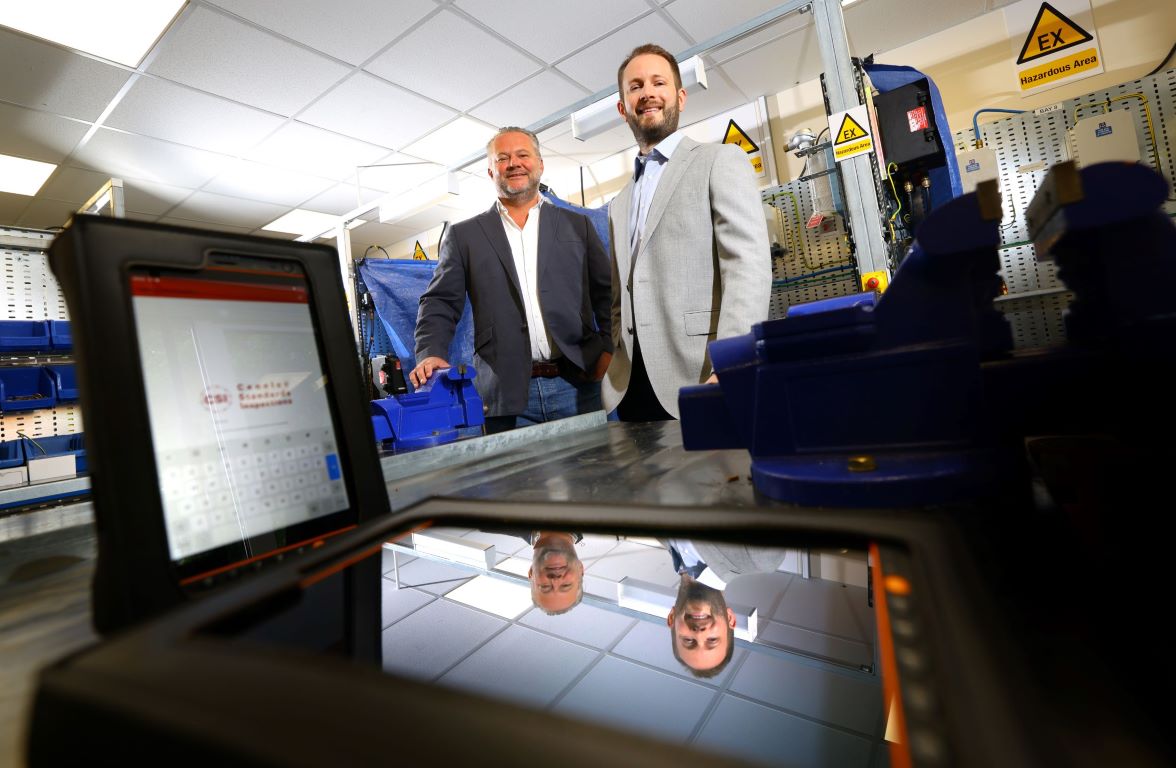

A North East hazardous area inspection firm is expanding its presence in continental Europe with the help of its latest investment from NEL Fund Managers.

Cenelec Standards Inspections Limited (CSI) helps companies operating in potentially explosive onshore and offshore environments, such as oil rigs and refineries, distilleries and chemical plants, to meet their extensive health and safety statutory obligations, and specialises in electrical and mechanical hazardous area inspections, repairs and installations.

The Cramlington-headquartered firm has recently won a major new contract with global food, agriculture and bioindustrial business Cargills which will see members of the CSI team working in a range of Cargills’ facilities across Europe.

Around 40 new jobs are being created through the new contract, with CSI now bringing in a £350,000 investment from the North East Growth Capital Fund Supported by The European Regional Development Fund to bring in the staff and equipment required to manage its growing continental workload.

It’s the fifth time that NEL has invested in CSI over the last decade, with previous capital being used to support the development of a high quality CompEx training centre in Newcastle, whilst also taking advantage of a range of commercial opportunities around the world.

Improvements to its training centre will also follow from its latest investment as CSI looks to extend the breadth of training packages that it can offer, including into the mechanical engineering sector.

Founded in 1986, CSI has around 110 personnel working with around 300 clients of all sizes in countries right around the world, and is aiming to double its annual turnover to around £10m in the next three years.

Electrical, instrument and mechanical inspections are carried out by CSI’s expert team using specialist hand-held equipment which enables compliance requirements to be quickly identified, reported and addressed via an online portal and any corrective actions required at any given site to be highlighted on the day of inspection.

CSI already provide services to a wide range of blue-chip companies, including Shell, BP, United Utilities, Centrica, ConocoPhillips, Diageo and William Grants and manages their clients’ compliance requirements from its regional headquarters.

Its North East client base includes Sterling, Pharmaron, Akzo Nobel and Organon and Lianhetech, while it also delivers senior management training courses in locations around the globe.

Managing director Jonathan Gibson says: “While the pandemic was a challenge for us, we came through it well and are ready to move into the next stage of the business’s development.

“We work with many of our clients through long-term multi-year framework agreements, which gives us the solid foundations needed to both develop strong relationships with their teams and proof of our expertise when we’re talking to potential new clients.

“Our work with Cargills will cover a wide range of different hazardous locations right across the continent, and has the potential to eventually go worldwide, which will have an even greater impact on our growth plans.

“NEL has been at the fulcrum of every major development in the business for the last decade and it made clear sense to speak to the team once again about our growth capital needs.”

Mike Guellard, Senior Investment Executive at NEL Fund Managers, adds: “Cenelec has earned a well-respected position in an industry that demands the very highest safety and service standard, and it’s great to see their continuing hunger to keep improving and expanding.

“Access to growth capital at different stages of development is essential if ambitious businesses are going to fully realise their potential and the management team here has set a great example of how to make this process work.”

NEL Fund Managers has been accredited under the Recovery Loan Scheme by the British Business Bank to provide loans of between £25,001 and £250,000 to regional firms as part of its wider investment offering of up to £500,000.

The North East Growth Capital Fund has been designed to create around 790 jobs in more than 70 regional firms over the life of the programme and offers unsecured investments of up to £500,000 to established businesses looking to realise their growth potential.

The overarching £130m North East Fund will provide financial support for more than 600 businesses, creating more than 2,500 jobs and delivering a legacy of up to £80m for further investment into the region.

NEL Fund Managers is also responsible for managing the £9m North East Small Loan Fund, which typically offers loans of up to £100,000 to businesses in Tyne & Wear, Durham and Northumberland.

For more information about NEL’s investment criteria, visit www.nel.co.uk or contact the investment team on 0345 369 7007.